Dr Matthew Thomas,

Social Policy and Alicia Hall, Statistics and Mapping

Key Issue

The high cost of housing in Australia has been at the forefront of a range of recent policy debates concerning Australia’s taxation arrangements. This brief examines housing affordability in Australia for both owners and renters over recent decades. It focuses particularly on those households which are most affected by high housing costs—those on low incomes in the private rental market.

What is housing

affordability?

The term ‘housing

affordability’ usually

refers to the relationship between expenditure on housing (prices, mortgage

payments or rents) and household incomes. The concept of housing affordability

is different to the concept of ‘affordable housing’, which refers to low-income

or social housing.

Affordability for

owners

Housing affordability in Australia has broadly declined

since the early 1980s. The OECD’s price to

income ratio index shows a 78% increase between

1980 and 2015. In Sydney, which has experienced significant price rises over

the period, Parliamentary Library calculations indicate that the ratio of average

disposable household income (Australia-wide) to median house prices has

increased from approximately 3.3 in June 1981, to just over seven in June 2015.

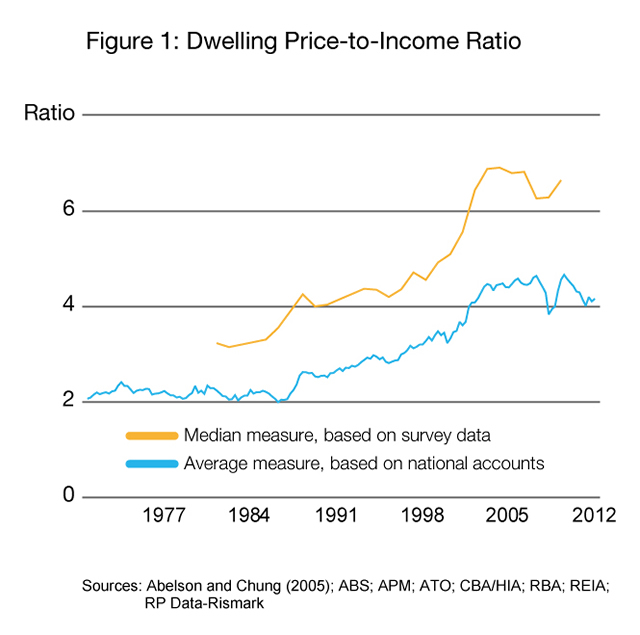

The following graph illustrates Australia-wide ratios from

the early 1970s to 2012.

Source: R Fox and R Finlay, Dwelling

prices and household income, RBA Bulletin, December Quarter 2012.

Much of the growth in housing prices relative to

incomes took place during the

late 1980s, 1990s and early 2000s. In this context, the Reserve Bank of

Australia’s 2014 submission

to the Senate

Economics References Committee Inquiry into Affordable Housing noted ‘Australian

housing prices increased by about two thirds relative to income in the decade

or so up to around the end of 2003’.

Partly as a consequence of rising house

prices between 1984 and 2009–10, the Australian Bureau of Statistics’ (ABS) Household Expenditure

Survey

indicates that the estimated proportion of average weekly household expenditure

on current housing increased from approximately 12.8% to 18.0%. Some of this

increase is likely to represent changing societal preferences, with households choosing

to put more of their household budget into larger, more comfortable or better-located

homes. This has been facilitated through financial deregulation and a

significant growth in household disposable incomes between 1980 and 2010.

Of course, affordability differs between the states

and territories, and between capital cities and regional areas. As an

indication, Table 1 shows nominal median house prices in each of the capital

cities in March 1980, and March 2016.

Table 1: Capital cities’ nominal median

house prices

| |

March

1980 |

March

2016 |

| Sydney* |

$64 800 |

$999 600 |

| Melbourne |

$40 800 |

$713 000 |

| Brisbane* |

$34 500 |

$480 000 |

| Adelaide |

$36 300 |

$445 000 |

| Perth |

$41 500 |

$520 000 |

| Canberra |

$39 700 |

$570 000 |

| Hobart |

Not available |

$385 000 |

| Darwin |

Not available |

$582 500 |

Source: Time series data purchased from

the Real Estate Institute of Australia by the Parliamentary Library. *REIA

advises that comparisons over time for Sydney and Brisbane should be made with

caution.

Rising house prices are one factor behind the

declining levels of home ownership in Australia. The 2016 Household,

Income and Labour Dynamics in Australia Survey: Selected Findings from Waves 1

to 14 reports that, in 2001, 68.8% of

households were owner-occupied, compared to 64.9% in 2014. This trend is most

prevalent in Victoria (7.8 percentage point decline) followed by New South

Wales (4.3 percentage point decline), and South Australia (2.5 percentage point

decline).

Measurements of housing affordability

There are two major approaches to the measurement of housing affordability in policy discussions in Australia—ratio measures and residual measures. Ratio measures focus on the relationship between housing expenditure (prices or costs) and household income, either as a median or mean. The ABS, the OECD and various housing industry associations publish ratio measures. As outlined by Gabriel, Jacobs, Arthurson, Burke and Yates in their 2005 paper Conceptualising and measuring the housing affordability problem, residual measures emphasise the capacity of a household to maintain an acceptable standard of living after housing costs. Given the level of complexity associated with their calculation, residual measures are typically published by researchers and academics.

Affordability for

renters

The ABS’ Housing

Occupancy and Costs publication indicates that between 1994–95 and 2013–14,

the proportion of households which are renters has increased from 26% to 31%.

In addition, the proportion of households renting from private landlords has

increased from 18% to 26% over the same period.

On average, private renters spend more of their gross

household income on housing costs than other tenure types. Specifically, the ABS

reports private renters spent 20% of their gross household income on

housing costs in 2013-14, compared with 16% for those with a mortgage.

The cost of renting privately has increased

significantly over the period between

1994–95 and 2013–14. The ABS’ Housing

Occupancy and Costs publication indicates a 62% increase in average weekly housing costs

(after inflation). This compares to a 42% increase for owners with a mortgage

and 45% for public renters.

What is housing stress?

A household is typically described as being in ‘housing stress’ if it is paying more than 30% of its income in housing costs. As higher income households can spend a higher proportion of their income on housing without experiencing problems, they are often excluded from these types of analysis. Consequently, a ratio of 30/40 is often used as a benchmark—that is, if households that fall in the bottom 40% by income spend more than 30% of their income on housing, they are defined as being in housing stress. Confusingly, both gross and disposable incomes are referenced by researchers when referring to housing stress.

Affordability in

the private rental market for those on low incomes

Much of the recent public debate about housing

affordability has focused on the inability of many would-be home owners—and

young people in particular—to break into the property market, and factors

contributing to this. Rather less attention has been paid to the difficulties

faced by low-to-medium-income earners who are obliged to compete with people on

higher incomes for a limited number of affordable rental properties in the

private rental market in areas with greater employment opportunities.

In 2012, the National Housing Supply Council (NHSC)

estimated

that as at 30 June 2011, the gap between overall housing supply and demand was

228,000 dwellings. The NHSC also estimated that there was a deficit of 539,000

affordable rental properties for lower income renters. Anglicare Australia’s

annual rental affordability snapshots suggest that the situation for lower

income renters remains difficult. The latest

Anglicare survey of 75,410 rental properties across Australia, conducted in

April 2016, found that at a national level, only 21 properties were affordable

for single adults living on Newstart Allowance, and only one was suitable for a

single person living on Youth Allowance.

In this context, an increasing number of Australian

renter households are experiencing housing stress. In 2013–14, the ABS found

50.1% of low-income renter households

had housing costs greater than 30% of gross household income (which includes

Commonwealth Rent Assistance (CRA)). While the

provision of CRA has helped

to reduce the number of Australian households in housing stress, Parliamentary

Library calculations indicate that for a substantial and growing proportion of

people renting in certain parts of Australia, rental costs are rising at a

higher rate than CRA thresholds and rates.

For those low-income households in greatest need,

the federal, state and territory governments provide social housing. However,

the stock of social housing is not increasing at a rate sufficient to keep up

with demand, and waiting lists for social housing remain long. At

30 June 2015, there were 199,133 households on social housing waiting lists.

Government response

Housing affordability

did not receive significant attention during the 44th Parliament. The

Government had committed to undertake a

review of housing and homelessness policies and programs as part of the reform

of the federation white paper process, with housing issues also to be

considered as part of the white paper on the reform of Australia’s tax system.

However, the status of this review is unclear given the cessation of both of

the white papers.

On 7 January 2016, the Government announced that the COAG Council

on Federal Financial Relations would form an Affordable Housing Working Group.

This group has been charged with identifying ways of increasing the supply of

affordable housing for people on low incomes and implementing trials of models

of such arrangements. To this end, the Working Group released an issues paper and called for

submissions on ways to boost the supply of affordable rental housing through

innovative housing models. The consultation process

was completed on 6 April 2016.

If the supply of affordable housing is to be increased

sufficiently to meet medium- to long-term demand, then this could be met

through (among other things) institutional investment in the affordable end of

the residential market.

The main barrier to such investment would

appear to be that institutional investors have shown

relatively little interest in affordable housing, largely due to perceptions of

risk and affordable housing’s comparatively low returns. If investors’

reluctance is to be overcome then it is likely that this will require

government incentives and the introduction of some form of financial instrument

(similar to the discontinued National Rental Affordability Scheme).

The Affordable Housing Working Group is currently

considering the merits of a number of such instruments and Australian Housing

and Urban Research Institute (AHURI) researchers have undertaken a significant

amount of research on Housing Supply Bonds and an Affordable Housing Finance

Corporation Model.

Financing instruments such as these could help to

increase the supply of affordable housing over the longer term. However, if low-income

households currently experiencing housing stress are to gain some respite, then

this might suggest the need for a more immediate response. Such a response

could include changes to the levels and indexation of CRA to ensure that it

better reflects the costs of rental housing, as recommended by the Henry

Review of the tax system and the McClure

Review of the welfare system.

Further reading

Senate Select Committee on Housing Affordability, A good house is hard to find: housing affordability in Australia, The Senate, Canberra, 2008.

National Housing Supply Council, Housing supply and affordability reform, Commonwealth of Australia, 2012.

Australia’s Future Tax System Review, Australia’s future tax system: report to the Treasurer: part two—detailed analysis, Commonwealth of Australia, Canberra, 2010.

Senate Economics References Committee, Out of reach? The Australian housing affordability challenge, The Senate, Canberra, 2015.

Back to Parliamentary Library Briefing Book

For copyright reasons some linked items are only available to members of Parliament.

© Commonwealth of Australia

Creative Commons

With the exception of the Commonwealth Coat of Arms, and to the extent that copyright subsists in a third party, this publication, its logo and front page design are licensed under a Creative Commons Attribution-NonCommercial-NoDerivs 3.0 Australia licence.